ETH Price Prediction: Will Ethereum Rally to $10,000?

#ETH

- Technical Momentum: MACD and Bollinger Bands suggest short-term bullish potential.

- Market Sentiment: Mixed news flow with institutional accumulation offsetting legal risks.

- Price Targets: $3,000 near-term; $10,000 possible in a macro bull run.

ETH Price Prediction

ETH Technical Analysis: Key Indicators and Price Outlook

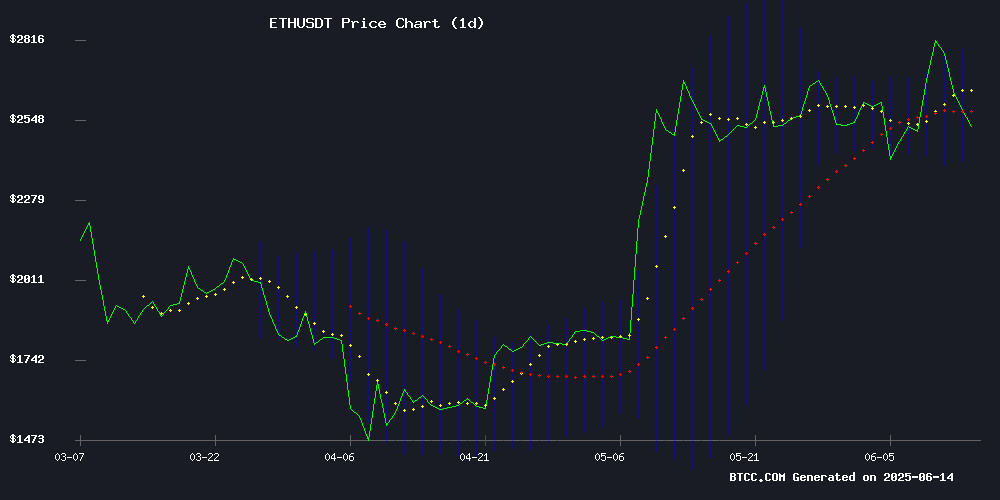

According to BTCC financial analyst James, ethereum (ETH) is currently trading at $2,564.60, slightly below its 20-day moving average (MA) of $2,596.19. The MACD indicator shows a bullish crossover with a value of 2.0699, suggesting potential upward momentum. Bollinger Bands indicate a neutral-to-bullish trend, with the price hovering near the middle band. A break above the upper band at $2,783.84 could signal a stronger bullish phase, while support lies at $2,408.53.

Market Sentiment: Mixed News Flow for Ethereum

BTCC financial analyst James notes that Ethereum''s market sentiment is mixed. Negative headlines include a 9% price dip amid market turmoil and legal challenges surrounding Tornado Cash. However, bullish catalysts include BlackRock''s $570M bet on ETH and SharpLink''s $463M accumulation. The Ethereum Foundation''s $1.25M commitment to legal defense and growing DeFi lending activity add further complexity to the sentiment.

Factors Influencing ETH’s Price

Ethereum Foundation Commits $1.25M to Support Tornado Cash Co-Founder''s Legal Defense

The ethereum Foundation has pledged $500,000 to aid the legal defense of Tornado Cash co-founder Roman Storm, who faces federal charges in the U.S. related to conspiracy and money laundering. The foundation will also match up to $750,000 in community contributions, bringing the total potential support to $1.25 million.

Storm''s trial, set for July 14, 2025, in Manhattan federal court, stems from allegations that Tornado Cash facilitated the laundering of over $1 billion in illicit funds. The Ethereum Foundation framed its donation as a defense of privacy and open-source development, stating, "Privacy is normal, and writing code is not a crime."

The case highlights the ongoing tension between regulatory oversight and the decentralized ethos of cryptocurrency. Tornado Cash, a crypto mixer, allowed users to obscure transaction trails—a feature authorities claim was exploited by malicious actors.

Tornado Cash Founder Accuses DOJ of Blocking Expert Witnesses in Pivotal DeFi Trial

Roman Storm, founder of privacy protocol Tornado Cash, claims the U.S. Department of Justice is systematically excluding his expert witnesses ahead of a landmark trial. Prosecutors rejected five of six proposed experts, including blockchain analyst Matthew Edman, whose testimony was severely restricted. The case stems from 2023 sanctions alleging Tornado Cash facilitated North Korean money laundering.

"I poured my soul into building non-custodial, unstoppable software," Storm tweeted, framing the trial as a broader attack on decentralized finance. Crypto leaders have rallied to his defense, contributing to a growing legal fund. The DOJ maintains the excluded witnesses—who WOULD have testified on blockchain mechanics and KYC applicability—failed to meet evidentiary standards.

The trial could set crucial precedents for developer liability in DeFi. Storm faces charges that he should have implemented controls on the Immutable smart contracts powering Tornado Cash—a contention that strikes at Ethereum''s foundational principles.

Ethereum Dips 9% Amid Market Turmoil as BlackRock Doubles Down with $570M Bet

Ether tumbled 9% in early trading, erasing $298 million from leveraged positions as panic selling gripped the market. The second-largest cryptocurrency found support near $2,500 after plunging from $2,771, with the sell-off attributed to broader risk aversion across digital asset markets.

Institutional players appear to be treating the dip as a buying opportunity. Open interest surged to $35.22 billion, with CME, Binance, and other major venues seeing $4 billion in average ETH exposure. A notable whale accumulated a $16.6 million long position during the downturn.

BlackRock continues its accumulation streak, purchasing ETH daily for over two weeks. The asset manager''s $73 billion crypto treasury suggests sophisticated investors view current levels as attractive entry points despite short-term volatility.

LastPass Hack Victim Loses $200K in Crypto Amid Ongoing Security Fallout

A cryptocurrency investor lost $200,000 in digital assets after hackers exploited stolen credentials from the 2022 LastPass data breach. The victim stored his Ethereum wallet seed phrase on the compromised password manager, enabling attackers to regenerate and drain his self-custody wallet.

The incident forms part of a broader pattern, with the LastPass breach linked to $4.4 million in crypto thefts from 25 users since 2023. One anonymous victim has filed a personal injury lawsuit in Washington, alleging LastPass failed to notify users about the security incident. The San Diego-based legal action highlights growing tensions between crypto security expectations and centralized custodial practices.

Security experts emphasize the immutable nature of seed phrases—once compromised, funds become irretrievable. The case underscores a persistent industry dilemma: even robust password management systems become single points of failure when used to store cryptographic keys.

Ethereum Price Could Rally To $10,000 If Major Resistance Is Broken

Ethereum''s price surged past $2,800 this week, marking its first breach of this level in four months. The altcoin briefly touched $2,870 before retracing slightly, signaling potential bullish momentum.

Crypto strategist Crypto Patel outlines two key scenarios. An 8-hour chart analysis suggests a near-term target of $4,000, while a two-week timeframe paints a more ambitious picture—a parabolic MOVE toward $10,000. The critical threshold lies at $2,750; sustained trading above this level could confirm the breakout.

The cryptocurrency has been range-bound between $2,366 and $2,734 since early May. This week''s upward thrust represents the first meaningful attempt to escape that consolidation. Market watchers now eye the $2,800 zone as the new battleground between bulls and bears.

Sharplink Ethereum Buy: Will This $463M Purchase Drive ETH?

SharpLink Gaming (Nasdaq: SBET) has made a staggering entry into the cryptocurrency market with its acquisition of 176,270.69 ETH, valued at approximately $463 million. This positions the company as the largest publicly-traded holder of Ethereum, signaling a significant vote of confidence in the asset''s long-term potential.

The move underscores growing institutional interest in Ethereum, particularly among publicly listed firms seeking exposure to digital assets. Such large-scale acquisitions often catalyze market momentum, though the long-term price impact depends on broader adoption trends and macroeconomic factors.

Ethereum Price Slides Despite SharpLink''s $463 Million Accumulation

Ethereum extended its decline by 6% on Friday, defying expectations after SharpLink Gaming''s landmark acquisition of 176,270 ETH worth $462.9 million. The Nasdaq-listed firm now holds the title of largest public ETH holder, staking 95% of its position at an average entry price of $2,626 per token.

Geopolitical tensions overshadowed the institutional buying spree as Israeli strikes on Iran fueled risk-off sentiment across crypto markets. Technical analysts warn of potential downside to $2,260 if ETH fails to hold support at the 50-day moving average.

SharpLink''s strategic move combines capital allocation with network participation, earning staking rewards while bolstering Ethereum''s security. "This positions us at the intersection of financial opportunity and blockchain infrastructure development," the company stated, though markets remained focused on macro headwinds.

Sharplink Gaming Becomes Largest Public ETH Holder With $462M Purchase Amid Stock Volatility

Sharplink Gaming has cemented its position in the cryptocurrency market by establishing an Ethereum Treasury Reserve and acquiring $462 million worth of ETH. The purchase of 176,270.69 ETH at an average price of $2,626 positions the company as the largest public holder of Ethereum, trailing only the Ethereum Foundation itself.

The funding strategy involved a $425 million private placement and a $79 million ATM equity offering, with nearly all proceeds directed toward ETH accumulation. Sharplink has deployed over 95% of its holdings into staking and liquid staking protocols, simultaneously securing Ethereum''s network and generating yield.

Despite the aggressive crypto accumulation, Sharplink''s stock (SBET) faced significant turbulence. Shares dropped 12.25% to $32.50 on Thursday before plunging to $8 in after-hours trading. A partial recovery to $11.05 on Friday still leaves the stock down substantially since the announcement.

SharpLink Stock Plummets Amid SEC Filing Confusion, Ethereum Treasury Move Signals Altcoin Shift

SharpLink Gaming''s stock collapsed nearly 66% in after-hours trading on June 13 following a misinterpreted SEC FORM S-3 filing. The Minneapolis-based online gambling firm had recently announced plans to establish an Ethereum-based treasury, signaling a strategic pivot toward cryptocurrency adoption in public markets.

Investors misread the shelf prospectus as an imminent dilution threat, triggering panic selling. SharpLink Chairman Joseph Lubin, who also heads Consensys, clarified the filing merely registered shares for potential resale by existing investors—a standard post-PIPE procedure in traditional finance. Consensys General Counsel Matt Corva dismissed the sell-off as unfounded FUD stemming from procedural misunderstandings.

The company''s $425 million Ethereum treasury allocation underscores growing institutional interest in altcoin diversification. This development comes as public markets increasingly recognize cryptocurrency reserves as legitimate treasury management tools, with Ethereum emerging as a preferred alternative to corporate cash holdings.

DeFi Lending Hits Three-Year High Amid Crypto Market Recovery

Decentralized finance lending volumes have surged to levels not seen since 2022, with active loans surpassing $24 billion. The resurgence signals renewed confidence in crypto markets following last year''s downturn, driven primarily by stablecoin liquidity demands and decentralized exchange trading activity.

Aave has emerged as the dominant lending protocol, displacing Curve from its previous leadership position. The sector''s growth reflects improved collateral trust and more sophisticated risk management tools, though NFT-backed lending remains depressed at just 3% of its former volume.

Ethereum continues anchoring the DeFi lending ecosystem despite recent liquidation events. The network currently carries $1 billion in potential liquidation positions, with ETH collateral thresholds beginning at $1,500 after the market''s recent rebound.

Maple Finance Partners with Lido Finance to Offer stETH-Backed Credit Lines

Cryptocurrency lending platform Maple Finance has joined forces with liquid staking provider Lido Finance, enabling institutional borrowers to access stablecoin credit lines using Lido''s stETH as collateral. The collaboration eliminates the need to unstake Ethereum positions while maintaining yield-generating exposure.

Lido''s stETH token represents staked ETH with DeFi compatibility, allowing holders to participate in decentralized finance ecosystems while accruing staking rewards. Maple''s in-house credit team will underwrite the loans, leveraging its $1.8 billion asset base and recent experience with Bitcoin-backed lending through Cantor Fitzgerald.

The partnership capitalizes on growing institutional demand for restaking strategies, where blockchain security extends to secondary applications. "This formalizes existing institutional use of stETH in capital strategies," said Maple CEO Sid Powell, noting the solution preserves staked assets'' productivity while unlocking liquidity.

How High Will ETH Price Go?

Based on technical and fundamental analysis, BTCC financial analyst James projects Ethereum could test $3,000 if it breaks the 20-day MA resistance at $2,596.19. A sustained bullish scenario might target $10,000, contingent on overcoming key resistance levels and positive market developments. Below is a summary of critical levels:

| Indicator | Value |

|---|---|

| Current Price | $2,564.60 |

| 20-Day MA | $2,596.19 |

| Bollinger Upper Band | $2,783.84 |

| MACD Signal | Bullish (2.0699) |